Venture Capital

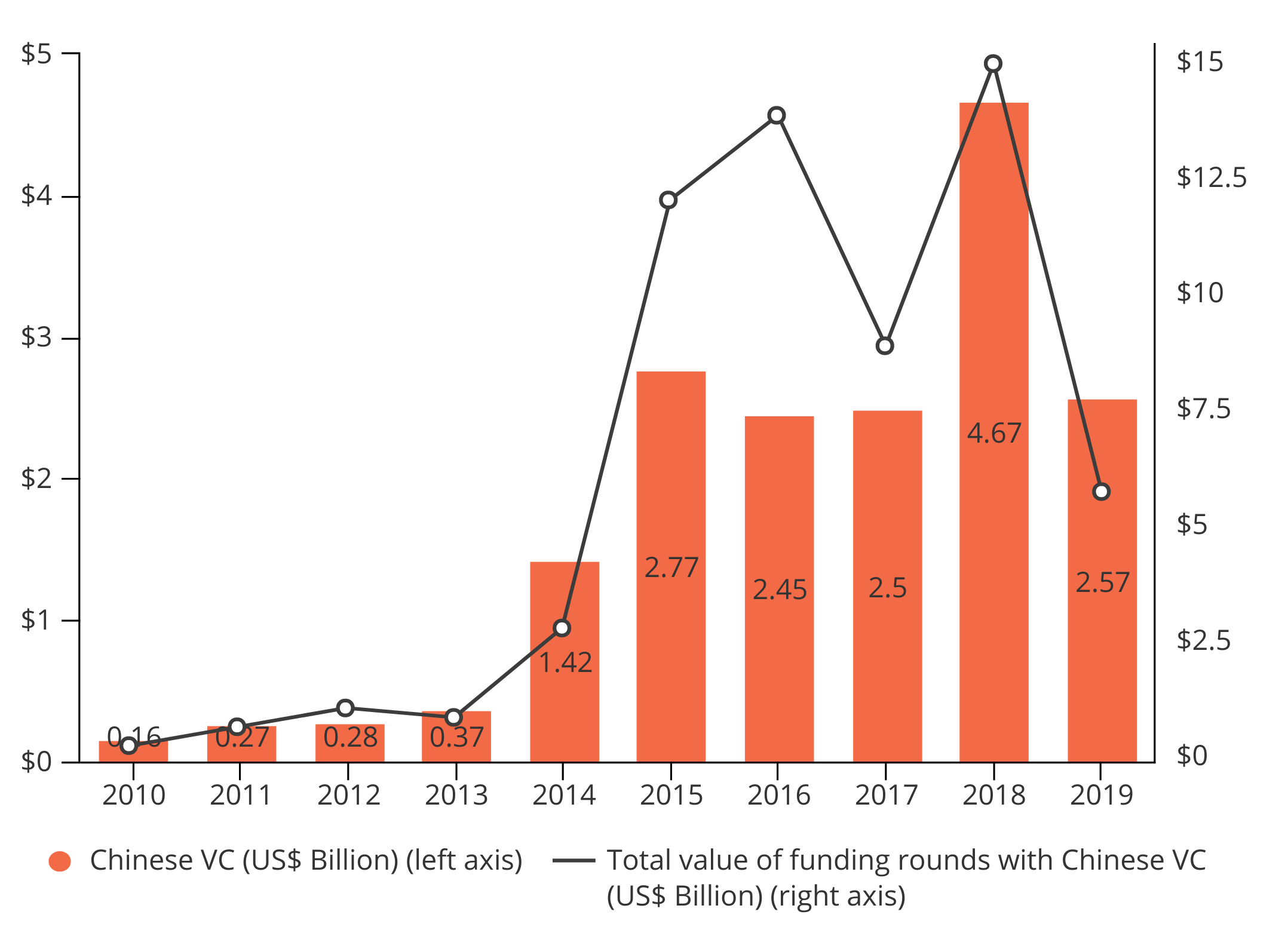

Venture capital (VC) is a form of portfolio investment (as distinct from FDI) provided to startups with high long-term growth potential. While there has long been significant American VC investment in Chinese startups, Chinese VC investments in the United States only passed $1 billion in 2014, before spiking to $4.7 billion in 2018.

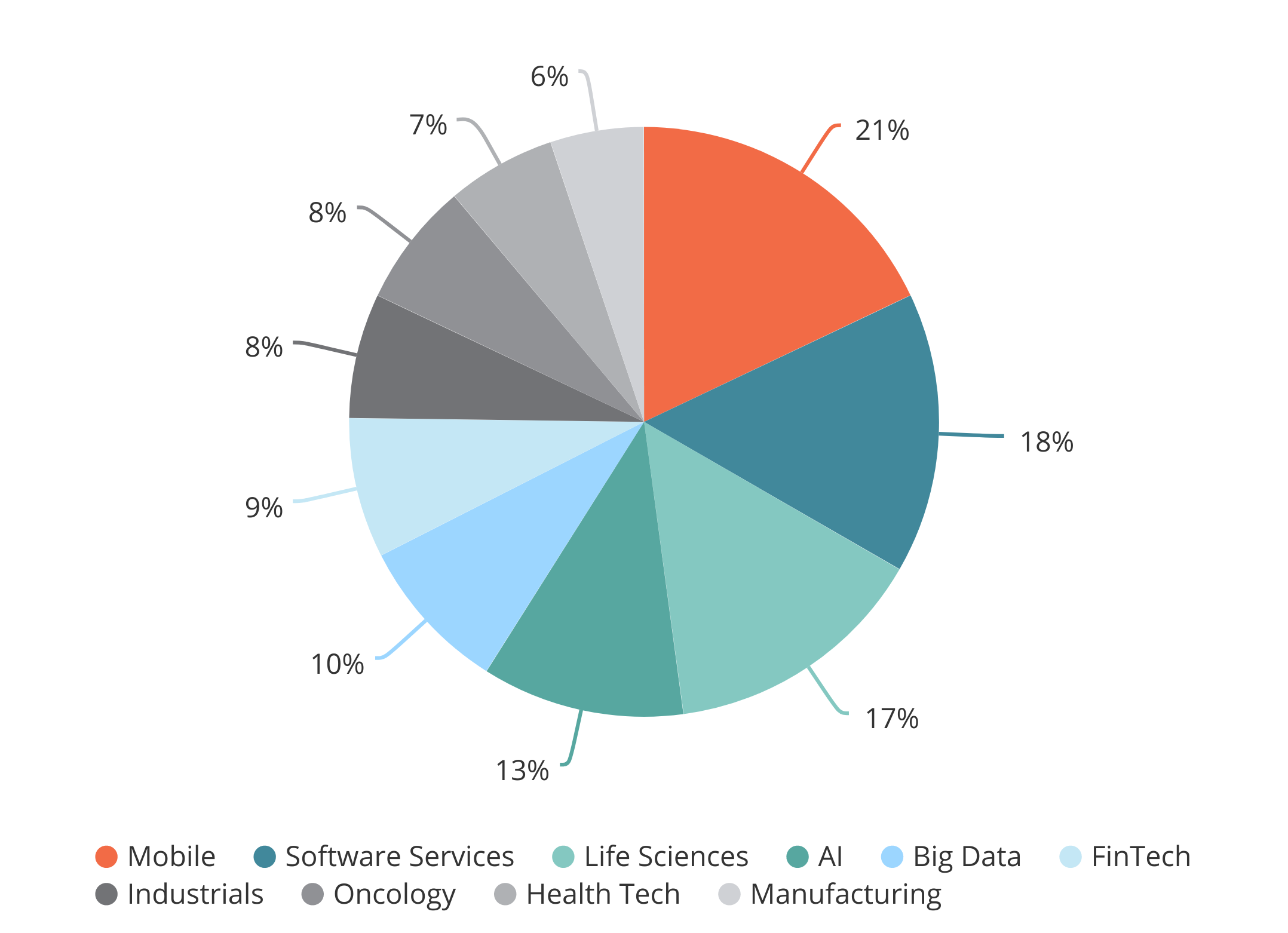

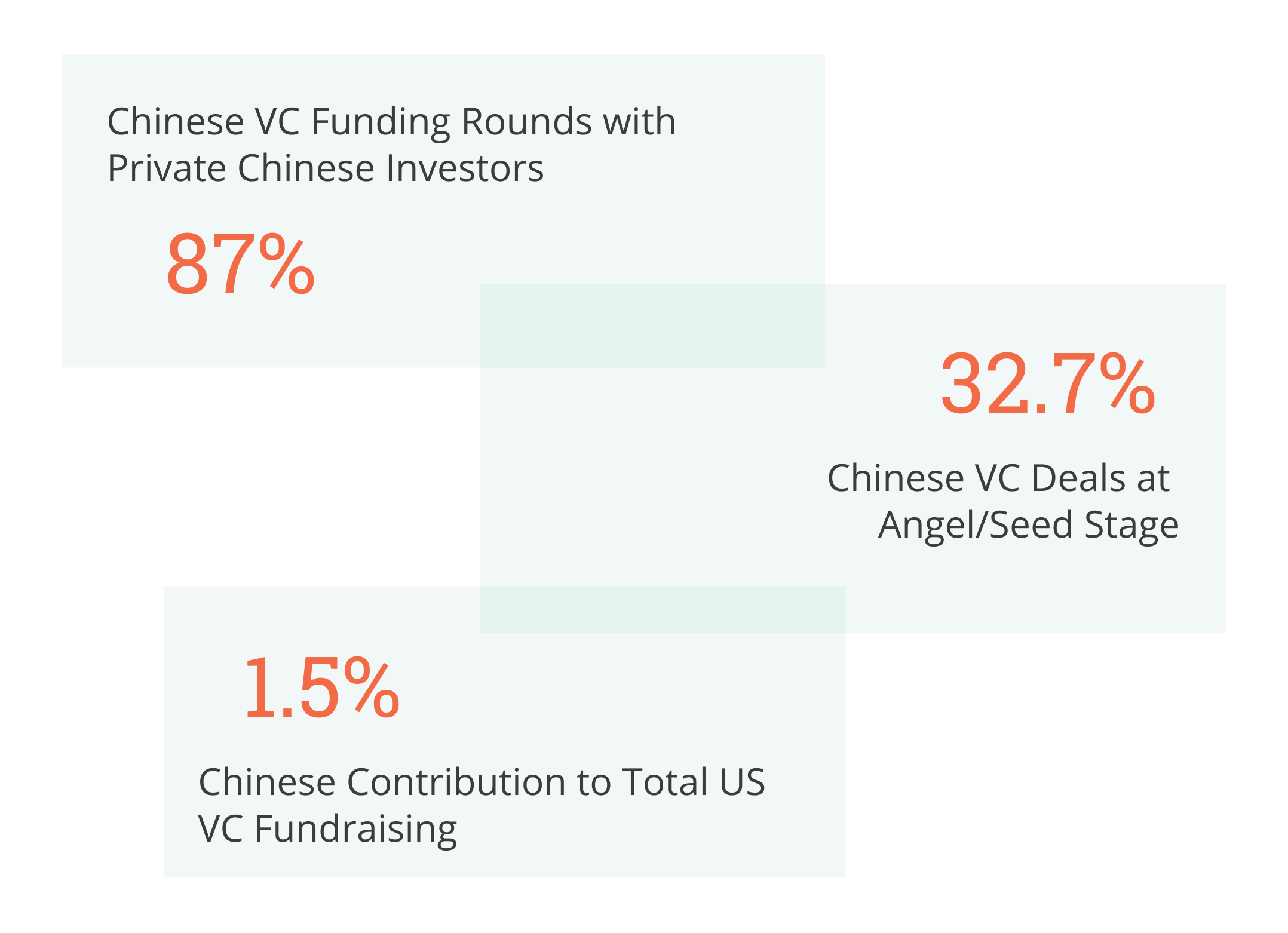

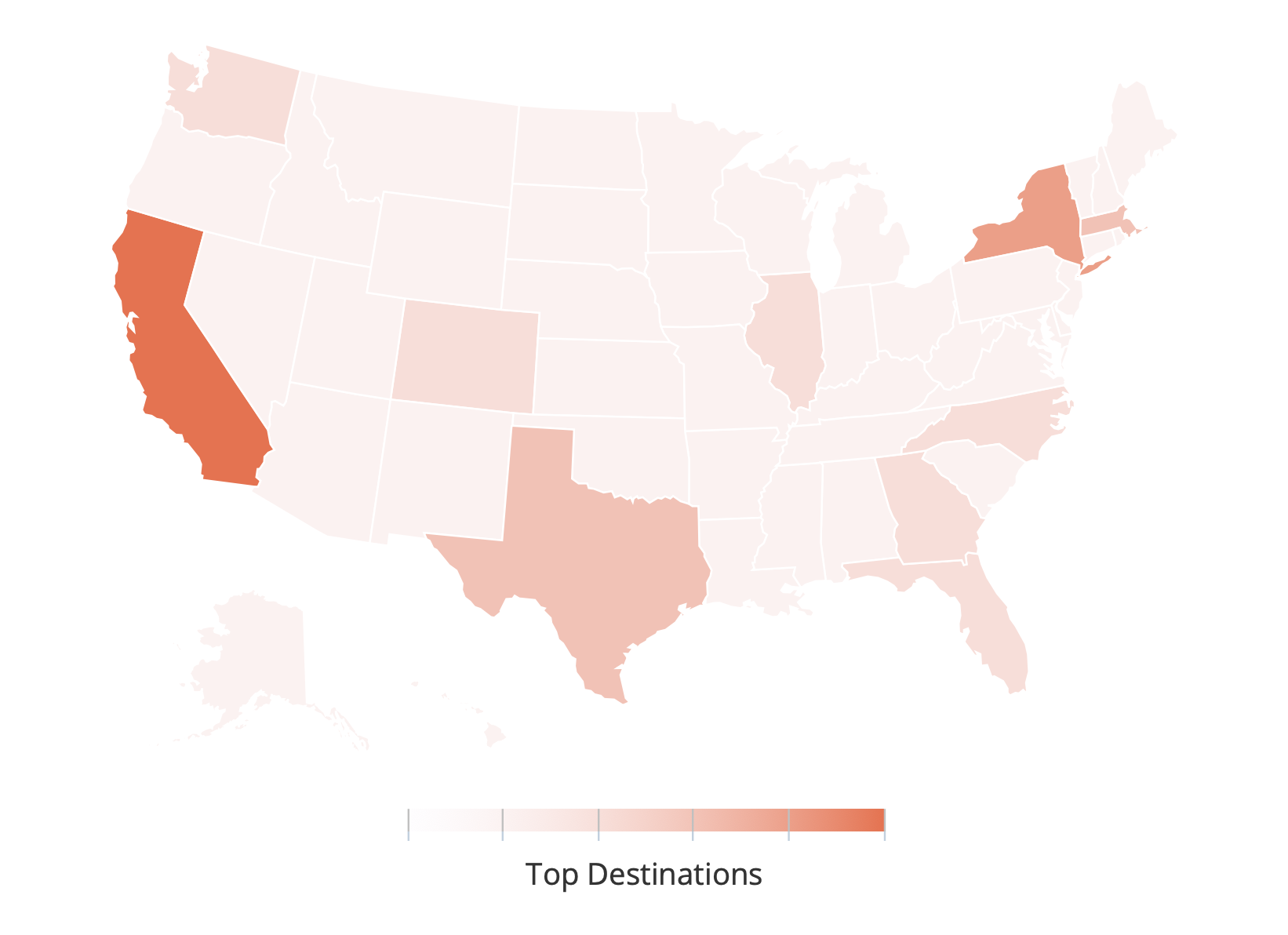

This capital is overwhelmingly from private VCs and directed at high-tech startups in Silicon Valley, with some activity in other tech hubs like New York, Boston, and Austin. But recent moves to tighten national security screening of Chinese investment in American tech means the future of such investments is increasingly cloudy.