Foreign Direct Investment

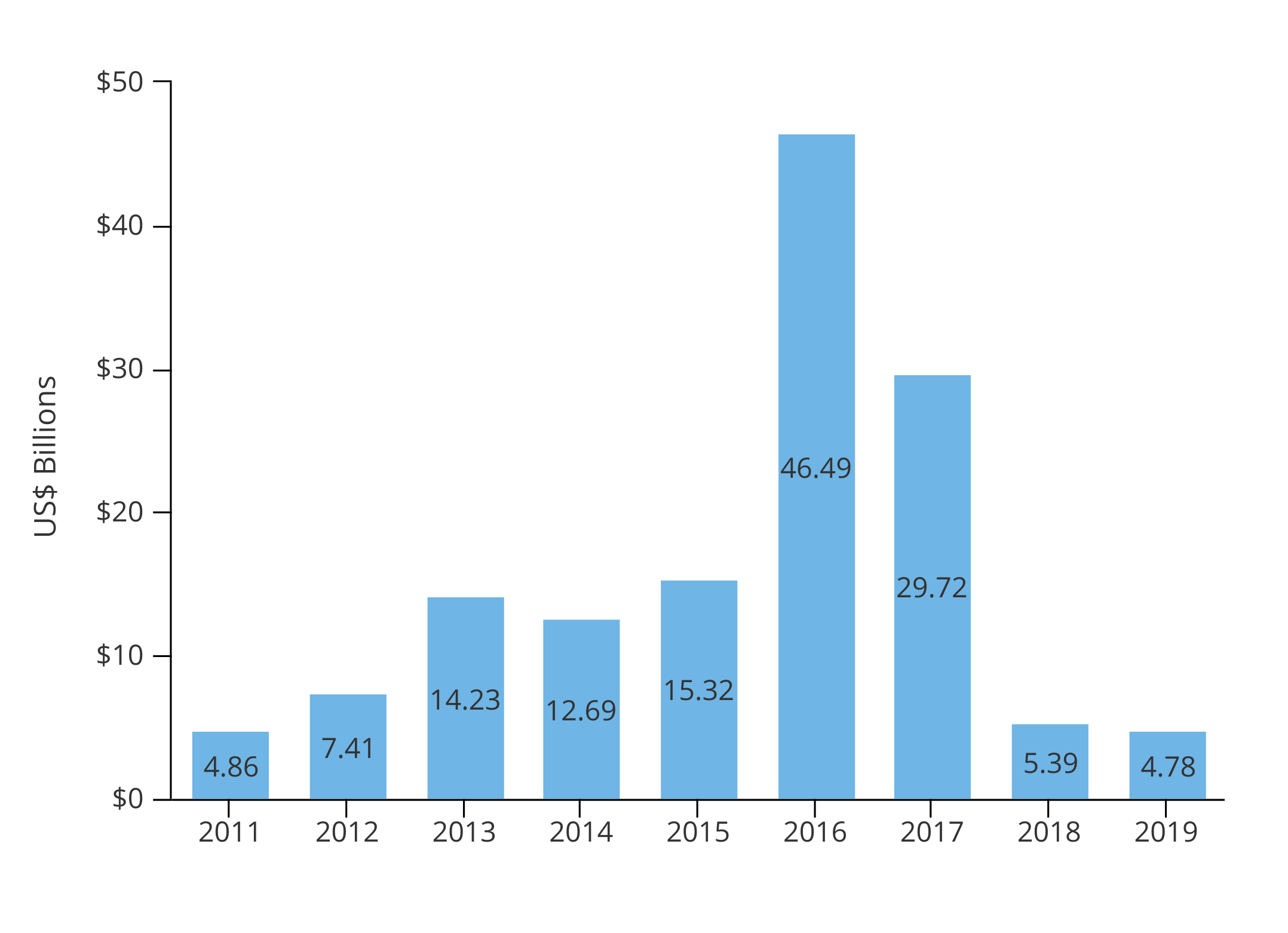

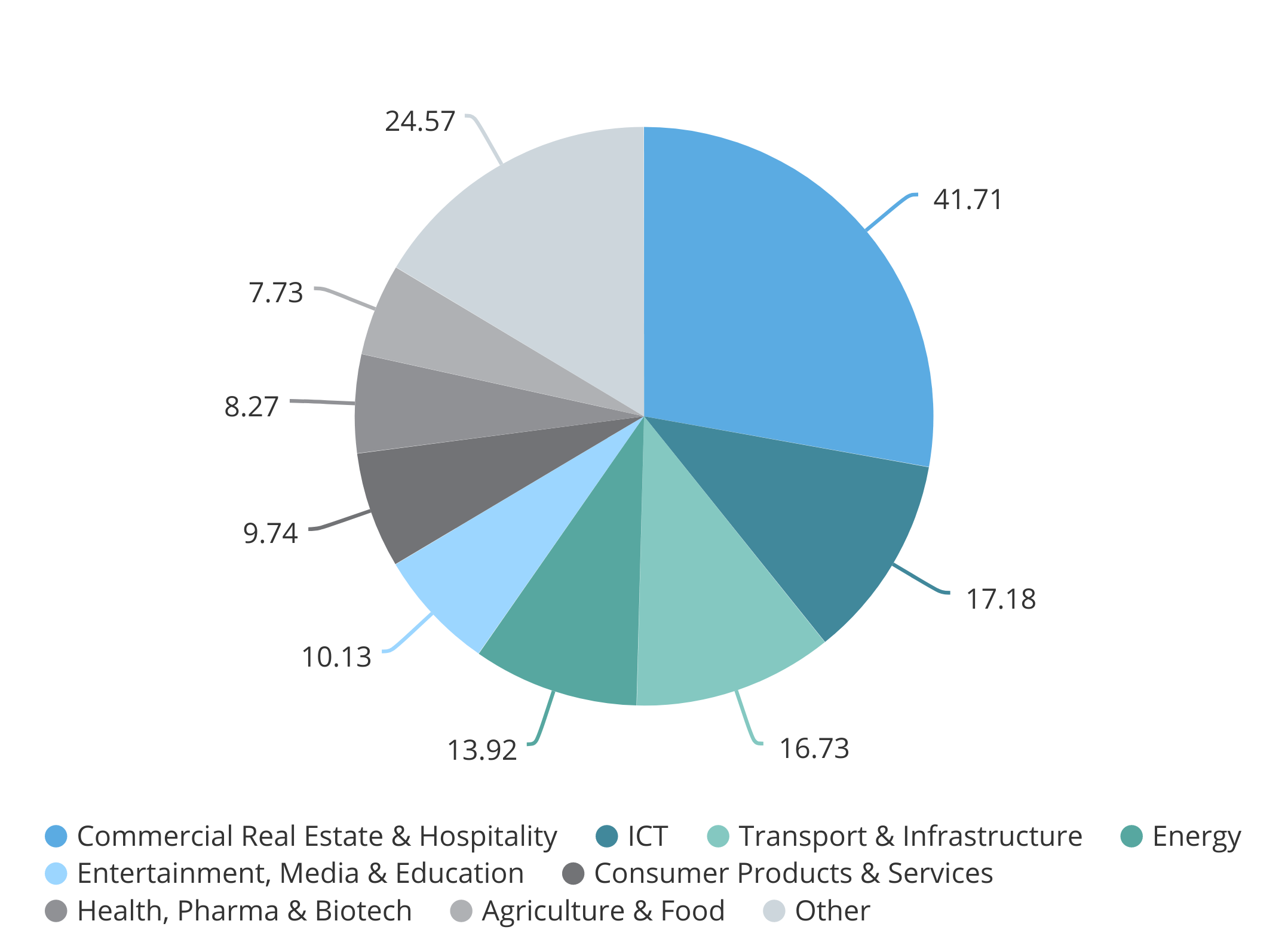

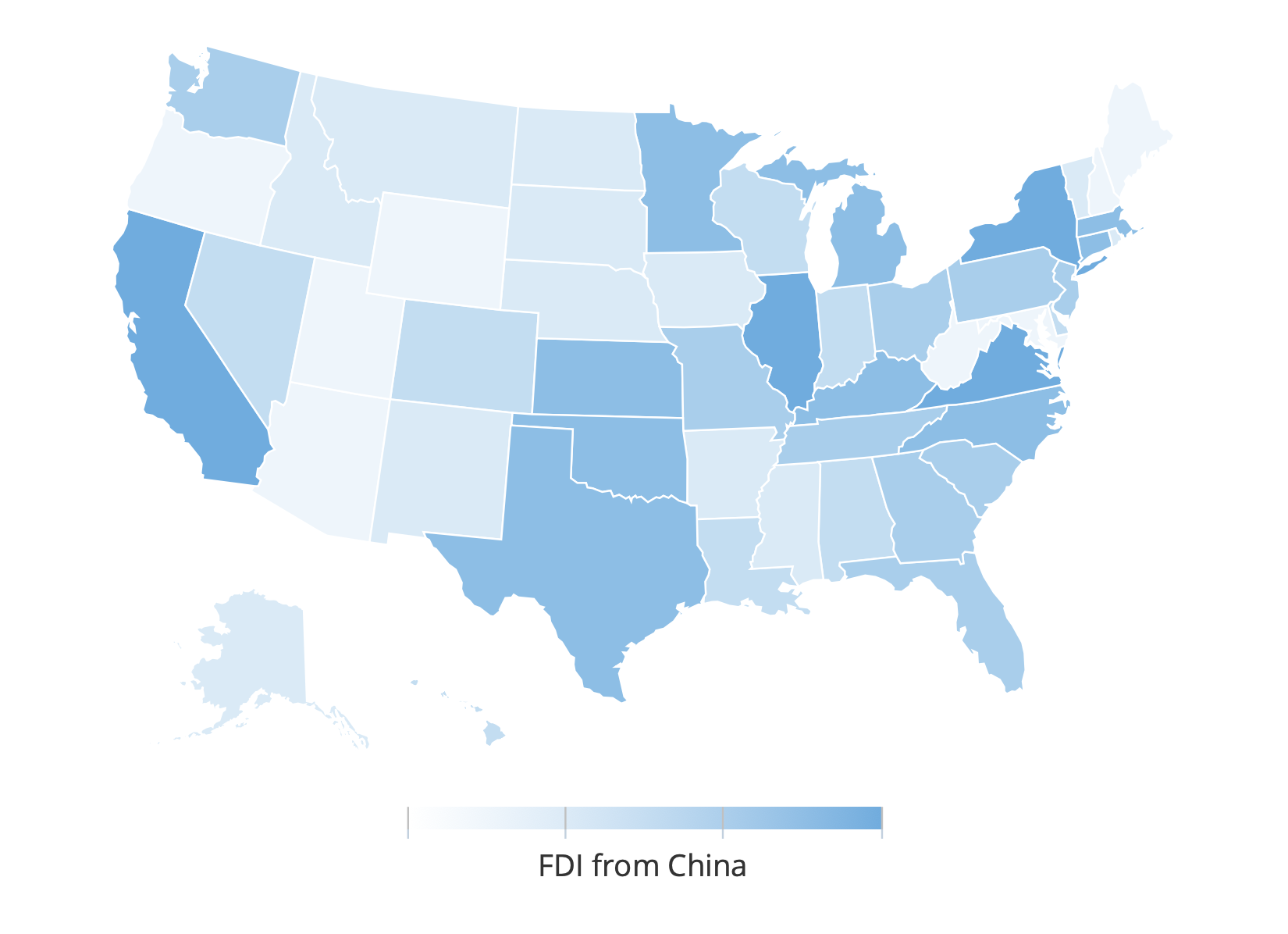

After several years of modest increases, Chinese foreign direct investment (FDI) into the United States ballooned to a mammoth $46.5 billion in 2016, before declining dramatically to pre-2011 levels due to capital controls from Beijing and heightened regulatory scrutiny in Washington. Chinese capital has supported American growth and jobs in projects from financial centers on the East Coast and manufacturing hubs in the Midwest to high-tech and entertainment industries on the West Coast.

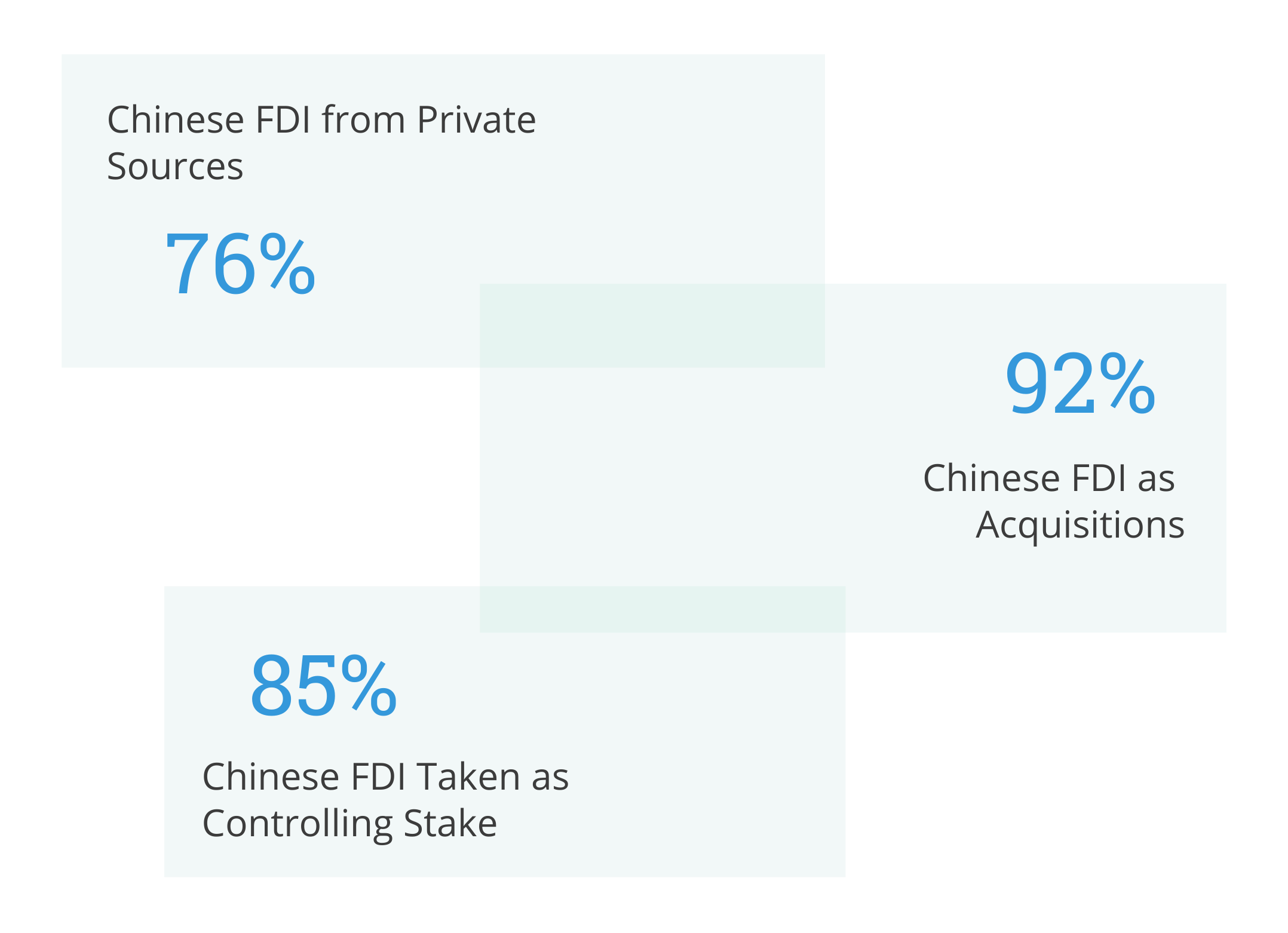

But this FDI also created political controversy, especially over acquisitions of sensitive technologies. All investors are sensitive to political risks and, whether considered an opportunity or a risk, Chinese FDI seems unlikely to return to its previous heights.